Accounting software for small business with inventory is an essential tool for managing your finances and tracking your inventory. With the right software, you can streamline your accounting processes, improve your inventory management, and gain valuable insights into your business performance.

In this guide, we’ll discuss the core features of accounting software for small businesses with inventory, the benefits of using such software, and how to choose the right software for your business.

Accounting Software Features for Small Businesses with Inventory

Accounting software is essential for small businesses that need to manage inventory. It can help businesses track their inventory levels, costs, and sales, and can generate reports that can help them make informed decisions about their inventory management.

There are a number of different accounting software packages available, each with its own set of features. Some of the core features that small businesses with inventory management needs should look for include:

- Inventory tracking: The software should be able to track the quantity and cost of each item in your inventory.

- Cost of goods sold (COGS) calculation: The software should be able to calculate the COGS for each item sold.

- Sales reporting: The software should be able to generate reports that show sales by item, customer, and date.

- Inventory valuation: The software should be able to value your inventory using different methods, such as FIFO, LIFO, and weighted average.

- Integration with other business systems: The software should be able to integrate with other business systems, such as your point of sale (POS) system and your customer relationship management (CRM) system.

There are a number of different accounting software packages that offer these features. Some of the most popular options include:

- QuickBooks

- Xero

- Sage 50cloud

- NetSuite

- Microsoft Dynamics GP

Using accounting software with inventory management capabilities can provide a number of benefits for small businesses. These benefits include:

- Improved inventory accuracy: Accounting software can help businesses track their inventory levels more accurately, which can lead to reduced shrinkage and improved profitability.

- Reduced costs: Accounting software can help businesses reduce their costs by automating tasks and improving efficiency.

- Improved decision-making: Accounting software can provide businesses with the information they need to make informed decisions about their inventory management.

- Increased sales: Accounting software can help businesses increase their sales by providing them with the information they need to target their marketing efforts and improve their customer service.

Inventory Management Capabilities: Accounting Software For Small Business With Inventory

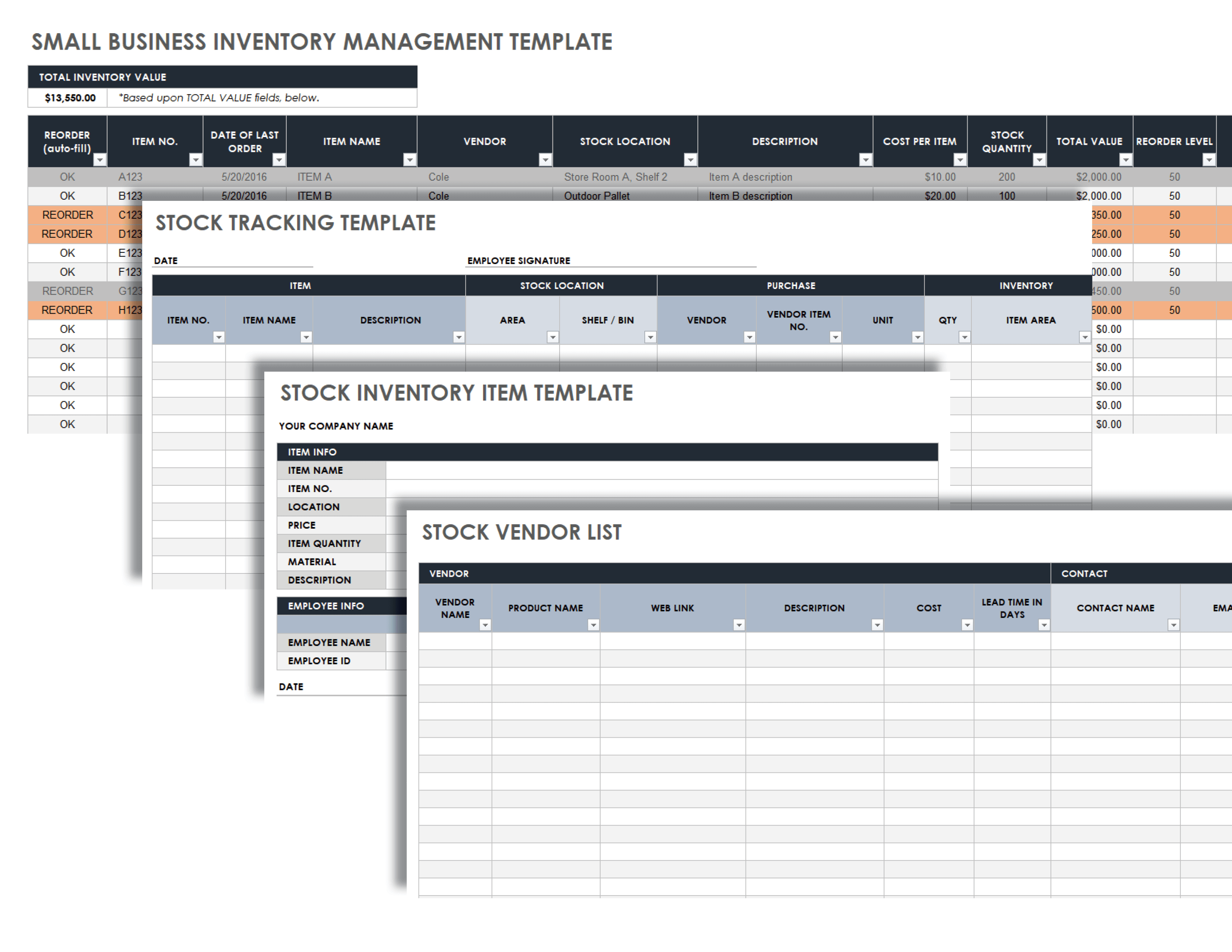

Effective inventory management is crucial for small businesses to maintain accurate stock levels, prevent overstocking or shortages, and optimize cash flow. Accounting software with robust inventory management capabilities can streamline these processes and provide valuable insights into inventory performance.

Real-Time Inventory Tracking

Real-time inventory tracking allows businesses to monitor stock levels in real-time, providing up-to-date information on the availability of items. This eliminates the need for manual inventory counts and reduces the risk of stockouts or excess inventory.

Multi-Location Inventory Management

For businesses with multiple locations, multi-location inventory management enables them to track inventory levels across different warehouses or stores. This provides a consolidated view of inventory and allows businesses to optimize stock allocation and minimize transportation costs.

Inventory Valuation Methods

Accounting software should support various inventory valuation methods, such as FIFO (First-In, First-Out), LIFO (Last-In, First-Out), and Average Cost. These methods determine the cost of goods sold and impact financial reporting. Choosing the appropriate method is essential for accurate inventory valuation and profitability analysis.

Inventory Adjustments and Transfers

Inventory adjustments and transfers allow businesses to account for inventory discrepancies, such as shrinkage, damage, or transfers between locations. These features help maintain accurate inventory records and ensure that the inventory system reflects the actual physical inventory.

Inventory Reports and Analysis

Robust inventory management capabilities include the generation of comprehensive inventory reports and analysis tools. These reports provide insights into inventory turnover, stock levels, and profitability. They help businesses identify trends, optimize inventory levels, and make informed decisions regarding purchasing and production.

Examples of Software with Robust Inventory Management Features

- QuickBooks Online

- Xero

- NetSuite

- Sage Intacct

- Microsoft Dynamics 365 Business Central

Integration with Other Business Systems

For small businesses with inventory, integrating accounting software with other business systems is crucial for streamlining operations and enhancing efficiency. This integration enables seamless data flow between different applications, eliminating manual data entry and reducing the risk of errors.

By connecting accounting software with e-commerce platforms, businesses can automate order processing, inventory updates, and payment reconciliation. This eliminates the need for manual data transfer, reducing the likelihood of errors and delays. Additionally, integration with CRM systems allows businesses to track customer interactions, manage sales pipelines, and generate invoices directly from within the accounting software.

Benefits of Integration

- Improved efficiency and reduced manual labor

- Enhanced accuracy and reduced errors

- Real-time data synchronization across systems

- Automated workflows and streamlined processes

Examples of Software with Seamless Integration

Several accounting software solutions offer seamless integration with other business systems. Some notable examples include:

- QuickBooks Online: Integrates with e-commerce platforms like Shopify and Amazon, as well as CRM systems like Salesforce and HubSpot.

- Xero: Offers integrations with e-commerce platforms like WooCommerce and BigCommerce, and CRM systems like Zoho and Pipedrive.

- Sage Business Cloud Accounting: Integrates with e-commerce platforms like Magento and PrestaShop, and CRM systems like Microsoft Dynamics 365 and Salesforce.

Reporting and Analytics

Small businesses need robust reporting and analytics capabilities from their accounting software to monitor inventory performance and gain valuable insights into their operations. These capabilities provide data-driven insights, enabling businesses to make informed decisions and improve their overall financial health.

Customized Reports

Customizable reports allow businesses to tailor their reporting to meet specific needs. They can create reports that focus on specific inventory items, categories, or time periods, providing granular insights into inventory performance.

Inventory Turnover Analysis

Inventory turnover analysis helps businesses understand how efficiently they are managing their inventory. By tracking the rate at which inventory is sold and replaced, businesses can identify slow-moving items and optimize their inventory levels to minimize waste and improve profitability.

Profitability Analysis

Reporting and analytics capabilities enable businesses to analyze profitability by inventory item or category. This information helps them identify high-performing products and make strategic decisions to maximize revenue and minimize expenses.

Integration with Other Business Systems

Integrating accounting software with other business systems, such as CRM and e-commerce platforms, enhances reporting and analytics capabilities. By consolidating data from multiple sources, businesses gain a comprehensive view of their operations and can identify trends and opportunities that might otherwise be missed.

Pricing and Implementation

When selecting accounting software for your small business, it’s crucial to consider the pricing models and implementation costs involved. Different software providers offer varying pricing options, and understanding these can help you make an informed decision.

Implementation costs are also a significant factor to consider. These costs cover the services of professionals who assist in setting up and customizing the software to meet your specific business needs.

Pricing Models

- Subscription-based pricing: A monthly or annual fee that provides access to the software and its features.

- Per-user pricing: A fee charged for each user who will be accessing the software.

- One-time purchase: A one-time payment that grants perpetual access to the software, but may not include future updates or support.

Implementation Strategies

The implementation strategy you choose will depend on the size and complexity of your business. Options include:

- Self-implementation: Installing and configuring the software yourself, which can save on costs but may require technical expertise.

- Assisted implementation: Working with a vendor or consultant to assist with the implementation process, providing guidance and support.

- Full-service implementation: Hiring a vendor to handle the entire implementation process, ensuring a smooth and efficient transition.

Choosing the Right Software and Implementation Plan

To choose the right accounting software and implementation plan, consider the following tips:

- Assess your business needs: Determine the specific features and functionality you require.

- Compare software options: Research different software providers and compare their features, pricing, and support.

- Estimate implementation costs: Factor in the costs of self-implementation, assisted implementation, or full-service implementation.

- Consider your budget: Determine how much you can afford to spend on accounting software and implementation.

User Interface and Ease of Use

For small businesses with inventory, user-friendliness and ease of use are paramount in accounting software. An intuitive interface simplifies navigation, data entry, and report generation, saving time and reducing errors.

When evaluating software usability, consider the following:

Menu Structure and Navigation

- Clear and logical menu structure for easy access to features.

- Efficient navigation between modules and screens.

- Customization options to tailor the interface to specific needs.

Data Entry and Validation

- Simplified data entry forms with clear field labels.

- Automatic validation to prevent errors and ensure data integrity.

- Bulk import and export capabilities for efficient data handling.

Reporting and Analysis

- Predefined reports and customizable options for flexibility.

- Intuitive dashboards and visualizations for quick insights.

- Export options to share reports easily.

Examples of User-Friendly Software, Accounting software for small business with inventory

- QuickBooks Online: Known for its simple interface and user-friendly navigation.

- Xero: Offers a clean and intuitive design with easy-to-use features.

- Sage 50cloud: Provides a customizable interface and a range of user-friendly tools.

Customer Support and Resources

Reliable customer support and resources are crucial for small businesses using accounting software. They ensure that businesses can resolve issues quickly and efficiently, maximizing the software’s benefits.

Different types of support and resources include:

- Online help and documentation

- Phone, email, and live chat support

- Online forums and communities

- Training and webinars

Businesses should look for software providers that offer a comprehensive range of support options to cater to their needs.

Some examples of software that offer excellent customer support and resources include:

- Xero

- QuickBooks

- Sage

These providers offer a combination of online help, phone support, and training resources, ensuring that small businesses have the assistance they need to succeed.

Summary

Accounting software for small business with inventory can be a valuable asset for your business. By choosing the right software and implementing it effectively, you can streamline your accounting processes, improve your inventory management, and gain valuable insights into your business performance.

User Queries

What are the core features of accounting software for small businesses with inventory?

The core features of accounting software for small businesses with inventory include:

- Inventory management

- Invoicing and billing

- Accounts receivable and payable

- Financial reporting

- Bank reconciliation

What are the benefits of using accounting software for small businesses with inventory?

The benefits of using accounting software for small businesses with inventory include:

- Improved inventory management

- Streamlined accounting processes

- Increased accuracy and efficiency

- Improved financial reporting

- Better decision-making

How do I choose the right accounting software for my small business with inventory?

When choosing accounting software for your small business with inventory, you should consider the following factors:

- The size of your business

- The complexity of your inventory

- Your budget

- Your accounting needs

- Your technical expertise