In the realm of small business accounting, the harmonious marriage of inventory management and accounting software reigns supreme. This article will delve into the world of best accounting software for small business with inventory, empowering you with the knowledge to streamline operations, enhance financial accuracy, and propel your business to new heights.

As we navigate the complexities of inventory tracking and accounting, we’ll uncover the essential features to seek in accounting software, compare the leading options, and explore best practices for implementation and usage. Along the way, we’ll address additional considerations for small businesses, ensuring that you make an informed decision that aligns with your specific needs.

Understanding Small Business Accounting Needs with Inventory Management: Best Accounting Software For Small Business With Inventory

Small businesses face unique challenges in managing inventory and accounting. Inventory tracking can be complex, especially for businesses with a wide range of products or high turnover rates. Manual inventory management methods are prone to errors and can lead to inaccurate financial reporting.

Inventory tracking and accounting software can streamline operations and improve financial accuracy. These solutions provide real-time visibility into inventory levels, allowing businesses to make informed decisions about purchasing, pricing, and production. They also automate accounting processes, reducing the risk of errors and saving time.

Inventory Tracking Challenges for Small Businesses

- Maintaining accurate inventory records

- Tracking inventory in multiple locations

- Managing inventory with high turnover rates

- Preventing inventory loss and theft

- Optimizing inventory levels to meet demand

Benefits of Inventory Tracking and Accounting Software

- Real-time visibility into inventory levels

- Automated inventory tracking and accounting processes

- Reduced risk of errors and improved financial accuracy

- Improved decision-making based on accurate data

- Increased efficiency and productivity

Key Features to Consider in Accounting Software for Small Businesses

Small businesses have unique accounting needs, and choosing the right software can make a significant impact on their efficiency and profitability. When evaluating accounting software, it’s crucial to consider features that cater to their specific requirements, including inventory management capabilities.

Invoicing

Seamless invoicing is essential for small businesses. Look for software that allows you to create professional invoices quickly and easily, with customizable templates and automated payment reminders.

Expense Tracking

Keeping track of expenses is vital for financial management. Choose software that offers robust expense tracking features, including categorization, receipt scanning, and mileage tracking.

Reporting

Financial reporting provides valuable insights into your business’s performance. Select software that generates comprehensive reports, including profit and loss statements, balance sheets, and cash flow statements.

Inventory Tracking

For businesses with inventory, inventory tracking is crucial. Look for software that allows you to track stock levels, manage multiple warehouses, and optimize inventory levels to minimize waste and maximize profitability.

Comparison of Popular Accounting Software Options

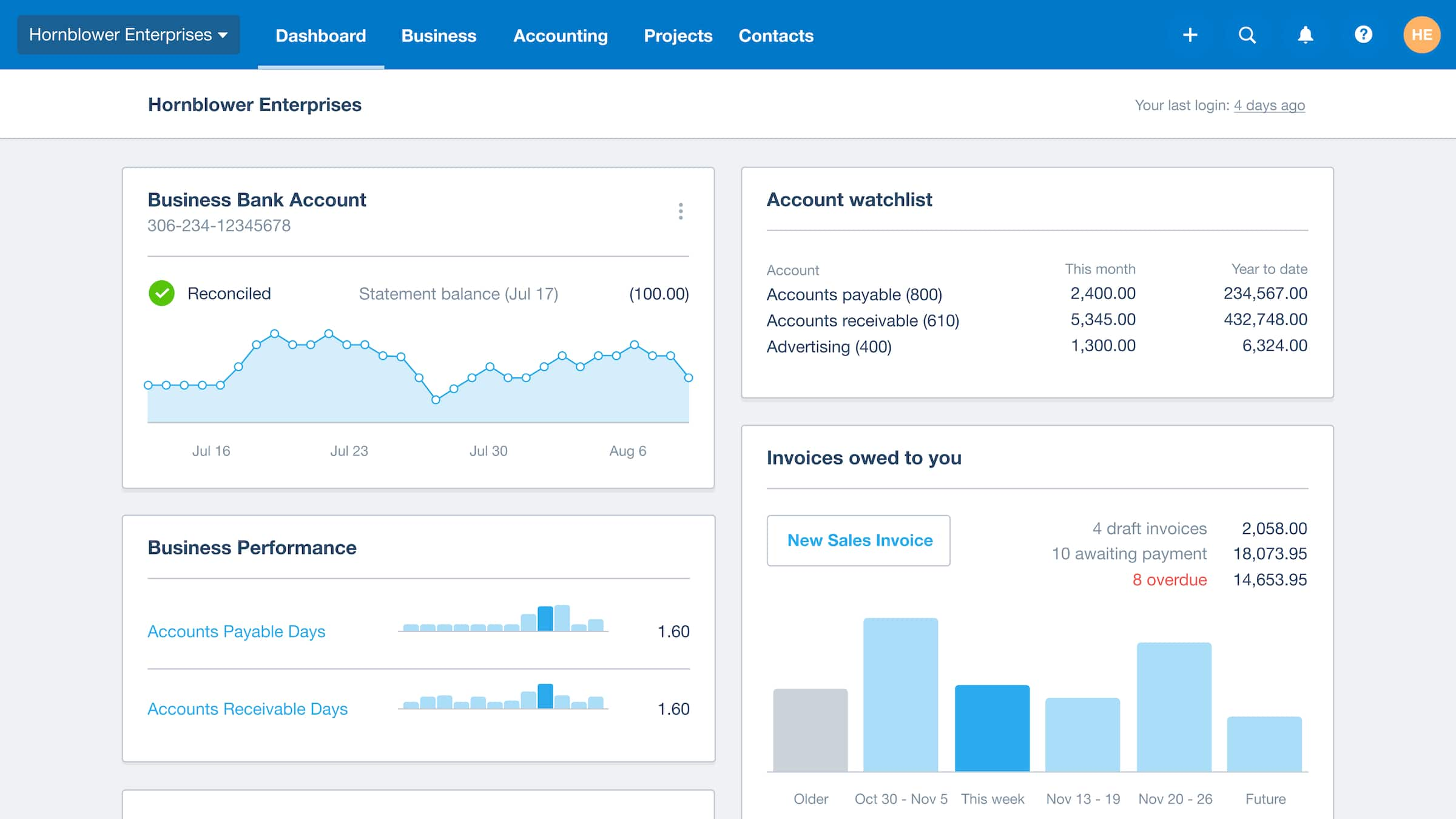

When choosing accounting software for your small business, it’s essential to consider your inventory management needs. Here’s a comparison of some popular options:

Software Comparison Table

| Software | Features | Pricing | Ease of Use | Customer Support |

|---|---|---|---|---|

| QuickBooks Online |

|

$25/month for Simple Start plan | Easy to use | 24/7 support |

| Xero |

|

$20/month for Starter plan | Intuitive interface | Online support and documentation |

| FreshBooks |

|

$15/month for Lite plan | User-friendly | Email and phone support |

| Zoho Books |

|

$19/month for Basic plan | Robust features | 24/7 chat and email support |

| Wave Accounting |

|

Free plan available | Simple and straightforward | Email support |

QuickBooks Online:Popular choice with comprehensive features, including inventory tracking, invoicing, expense tracking, and reporting. Pros: Easy to use, 24/7 support. Cons: Higher pricing.

Xero:User-friendly interface with inventory management, invoicing, expense tracking, and payroll capabilities. Pros: Intuitive design, online support. Cons: Limited inventory tracking features in lower-priced plans.

FreshBooks:Ideal for freelancers and small businesses with basic inventory tracking needs. Pros: User-friendly, affordable. Cons: Limited inventory management features.

Zoho Books:Robust feature set including inventory management, invoicing, expense tracking, and project management. Pros: Comprehensive features, 24/7 support. Cons: Can be complex for some users.

Wave Accounting:Free plan available, with inventory tracking, invoicing, expense tracking, and reporting. Pros: Free option, simple interface. Cons: Limited features, email support only.

Best Practices for Implementing and Using Accounting Software

Implementing and using accounting software effectively is crucial for small businesses with inventory. Here are some best practices to follow:

First, ensure accurate and consistent data entry. Establish clear guidelines for data entry, including who is responsible for entering data, when it should be entered, and how it should be formatted. Regularly review data entries for errors and make corrections promptly.

Inventory Management

Proper inventory management is vital for accurate accounting. Regularly track inventory levels, including quantities on hand, costs, and reorder points. Use inventory management features in your accounting software to automate tasks like stock level monitoring and purchase order generation.

Report Generation

Regularly generate financial reports to monitor your business’s financial performance. These reports should include income statements, balance sheets, and cash flow statements. Use these reports to identify trends, make informed decisions, and improve profitability.

Data Integrity, Best accounting software for small business with inventory

Maintaining data integrity is essential for accurate accounting. Implement measures to prevent unauthorized access to your accounting data, such as password protection and user permissions. Regularly back up your accounting data to prevent data loss in case of hardware failure or data breaches.

Training and Support

Provide adequate training to all users of your accounting software. Ensure they understand how to enter data accurately, generate reports, and perform other essential tasks. Offer ongoing support to users to answer questions and provide assistance when needed.

Additional Considerations for Small Businesses

When choosing accounting software, small businesses should consider factors beyond basic accounting needs. Industry-specific requirements, scalability, and integration with other business systems are crucial for efficient operations.

Businesses with high inventory turnover or complex management processes may require specialized software with robust inventory tracking capabilities.

Scalability

Choose software that can accommodate business growth. Consider the number of transactions, users, and data storage requirements in the future.

Integration

Integrate accounting software with other business systems, such as CRM, inventory management, and e-commerce platforms. This streamlines data flow and reduces manual errors.

FAQs

What are the key features to look for in accounting software for small businesses with inventory?

Essential features include invoicing, expense tracking, reporting, inventory tracking, and ease of use.

How can accounting software improve financial accuracy for small businesses?

By automating tasks, reducing errors, and providing real-time insights into financial data.

What are some best practices for implementing accounting software effectively?

Ensure data accuracy, train users thoroughly, and seek ongoing support to maximize software benefits.