Business inventory fiscal year tax is a crucial aspect of business management, affecting everything from financial reporting to tax implications. This guide delves into the intricacies of inventory management, exploring its impact on fiscal year reporting and providing insights into effective inventory control practices.

Understanding the interplay between business inventory and fiscal year tax is essential for optimizing business performance. By leveraging efficient inventory management methods and adopting appropriate inventory valuation techniques, businesses can minimize tax liabilities, enhance cash flow, and gain a competitive edge.

Business Inventory Management and Fiscal Year

Business inventory refers to the raw materials, work-in-progress, and finished goods held by a company for sale or use in production. Managing inventory efficiently is crucial for optimizing business performance and ensuring accurate fiscal year reporting.

Inventory management involves controlling the flow of goods, minimizing waste, and optimizing stock levels to meet customer demand. Effective inventory management can lead to reduced costs, improved cash flow, and enhanced profitability.

Common Inventory Management Methods

Various inventory management methods are used, including:

- First-In, First-Out (FIFO): Assumes that the oldest inventory is sold first, resulting in higher cost of goods sold (COGS) in inflationary periods.

- Last-In, First-Out (LIFO): Assumes that the most recently acquired inventory is sold first, resulting in lower COGS in inflationary periods.

- Weighted Average Cost: Calculates the average cost of goods sold based on the cost of all inventory on hand, regardless of when it was acquired.

- Specific Identification: Tracks the cost of each individual inventory item, providing the most accurate COGS but requiring detailed record-keeping.

The choice of inventory management method can significantly impact fiscal year reporting, particularly in periods of fluctuating costs. For example, LIFO can result in lower COGS and higher reported profits during inflation, while FIFO leads to the opposite effect.

Tax Implications of Inventory Valuation

The method used to value inventory has significant implications for a business’s taxable income and cash flow. The three primary inventory valuation methods are FIFO (first-in, first-out), LIFO (last-in, first-out), and average cost. Each method assumes a different flow of inventory and results in different tax consequences.

FIFO (First-In, First-Out)

Under FIFO, the cost of goods sold is assumed to be the cost of the oldest inventory on hand. This means that the first items purchased are the first items sold. As a result, FIFO tends to result in a higher cost of goods sold and a lower gross profit margin in periods of rising prices.

However, FIFO can also result in a lower taxable income in periods of falling prices.

LIFO (Last-In, First-Out)

Under LIFO, the cost of goods sold is assumed to be the cost of the most recent inventory purchased. This means that the last items purchased are the first items sold. As a result, LIFO tends to result in a lower cost of goods sold and a higher gross profit margin in periods of rising prices.

However, LIFO can also result in a higher taxable income in periods of falling prices.

Average Cost

Under average cost, the cost of goods sold is calculated by dividing the total cost of inventory by the number of units in inventory. This method results in a cost of goods sold that is somewhere between the FIFO and LIFO methods.

Average cost is often used because it is relatively simple to calculate and can provide a more stable cost of goods sold over time.

Impact on Taxable Income and Cash Flow, Business inventory fiscal year tax

The choice of inventory valuation method can have a significant impact on a business’s taxable income and cash flow. In general, FIFO will result in a higher taxable income and lower cash flow in periods of rising prices. LIFO will result in a lower taxable income and higher cash flow in periods of rising prices.

Average cost will result in a taxable income and cash flow that is somewhere between FIFO and LIFO.

Real-Life Examples

The following are some real-life examples of the tax consequences of different inventory valuation methods:

- In 2022, the price of steel rose significantly. A company that uses FIFO to value its inventory would have a higher cost of goods sold and a lower gross profit margin than a company that uses LIFO. This would result in a lower taxable income for the company that uses FIFO.

- In 2023, the price of oil fell significantly. A company that uses LIFO to value its inventory would have a lower cost of goods sold and a higher gross profit margin than a company that uses FIFO. This would result in a higher taxable income for the company that uses LIFO.

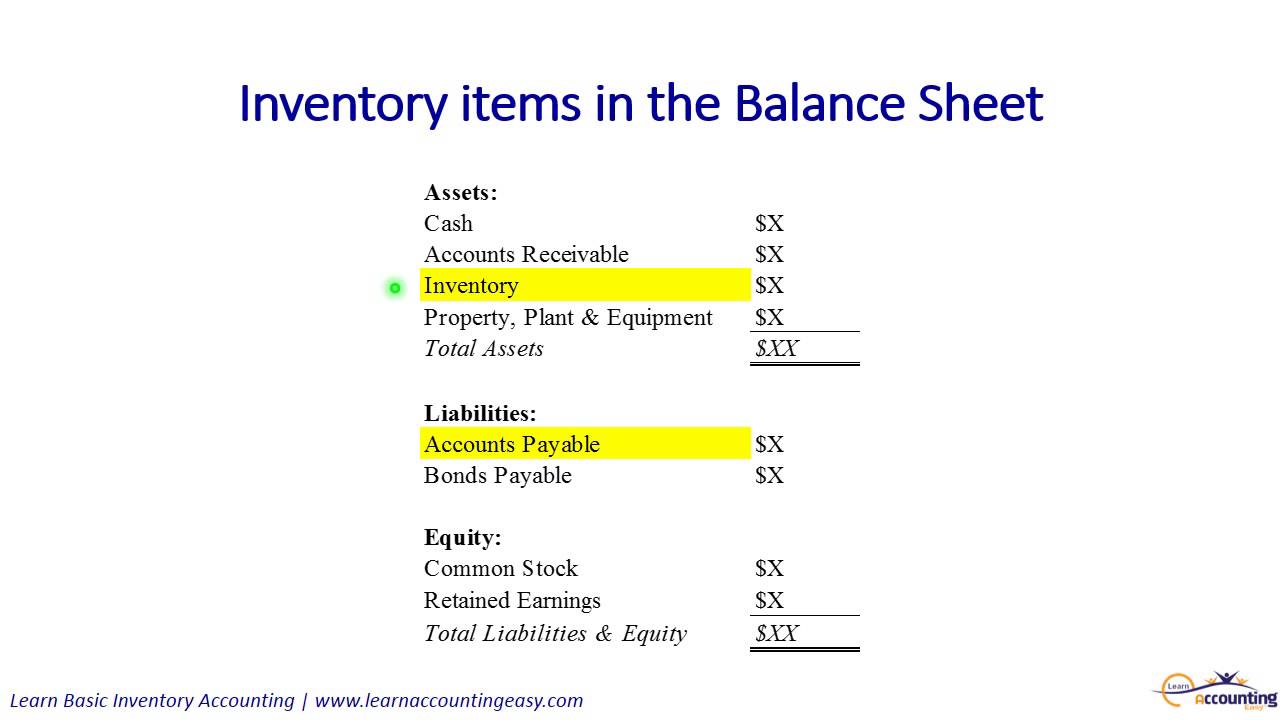

Inventory and Financial Reporting

Inventory plays a crucial role in financial reporting, significantly impacting both the balance sheet and income statement. It is a critical asset for many businesses, and its proper accounting treatment is essential for accurate financial reporting.

Accounting Principles and Standards

Inventory recognition and measurement are guided by established accounting principles and standards, such as the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP). These principles provide guidelines for the recognition, measurement, and disclosure of inventory information in financial statements.

- Recognition:Inventory is recognized when it is acquired and meets the definition of an asset.

- Measurement:Inventory is typically measured at the lower of cost or net realizable value.

- Cost:The cost of inventory includes all costs incurred to acquire and prepare the inventory for sale.

- Net Realizable Value:Net realizable value is the estimated selling price of inventory minus the estimated costs of completion and disposal.

Effective Disclosure

Adequate disclosure of inventory information in financial statements is essential for users to understand the company’s financial position and performance. This disclosure should include:

- Inventory Valuation Method:The method used to value inventory should be clearly disclosed.

- Cost of Goods Sold:The cost of goods sold should be disclosed separately from other expenses.

- Inventory Turnover:The inventory turnover ratio provides insights into the efficiency of inventory management.

- Slow-Moving or Obsolete Inventory:Any slow-moving or obsolete inventory should be disclosed and the related potential losses recognized.

Inventory Control and Auditing

Inventory control is a critical aspect of business management, ensuring the accuracy and security of inventory records. Effective control measures help prevent theft, damage, and obsolescence, minimizing losses and optimizing inventory utilization.

- Theft Prevention:Proper inventory control systems, such as physical barriers, security cameras, and access controls, deter theft and unauthorized access to inventory items.

- Damage Control:Implementing proper storage conditions, handling procedures, and regular inspections helps prevent damage to inventory, reducing the risk of losses and ensuring product quality.

- Obsolescence Control:Tracking inventory turnover rates and implementing inventory management techniques like First-In, First-Out (FIFO) or Last-In, First-Out (LIFO) helps minimize the risk of holding obsolete or slow-moving items, reducing potential losses.

Techniques for Effective Inventory Control

Effective inventory control involves a combination of techniques and best practices:

- Cycle Counting:Regular physical counts of inventory items help identify discrepancies between physical inventory and inventory records, ensuring accuracy.

- Inventory Management Software:Using inventory management software provides real-time visibility into inventory levels, facilitates tracking, and automates inventory processes.

- Vendor Management:Establishing clear communication and coordination with vendors ensures timely delivery, accurate order fulfillment, and minimizes inventory shortages.

Inventory Auditing Procedures

Inventory audits are essential for verifying the accuracy and compliance of inventory records. Common procedures include:

- Physical Verification:Comparing physical inventory counts to inventory records to identify any discrepancies or inaccuracies.

- Cut-Off Testing:Verifying that all transactions occurring before and after the audit period are properly recorded in the inventory records.

- Valuation Testing:Reviewing the methods used to value inventory and ensuring they comply with applicable accounting standards and regulations.

These procedures help ensure the reliability of inventory records, support financial reporting, and reduce the risk of misstatements or fraud.

Technological Advancements in Inventory Management: Business Inventory Fiscal Year Tax

The rapid advancement of technology has had a profound impact on the way businesses manage their inventory. From sophisticated software solutions to cutting-edge technologies like RFID and data analytics, technological advancements are transforming inventory management practices, offering numerous benefits and challenges.

Software Solutions

Inventory management software has become an indispensable tool for businesses of all sizes. These software solutions streamline inventory tracking, automate ordering processes, and provide real-time visibility into stock levels. By leveraging advanced algorithms and machine learning capabilities, inventory management software can optimize inventory levels, reduce waste, and improve overall efficiency.

RFID Technology

Radio Frequency Identification (RFID) technology uses radio waves to track inventory items. RFID tags can be attached to individual items or pallets, allowing businesses to track their movement throughout the supply chain. This technology eliminates the need for manual scanning and reduces the risk of errors, providing real-time visibility into inventory levels and enhancing supply chain efficiency.

Data Analytics

Data analytics plays a crucial role in modern inventory management. By analyzing historical data and identifying patterns, businesses can gain valuable insights into demand trends, lead times, and other key metrics. This data-driven approach enables businesses to make informed decisions, optimize inventory levels, and improve forecasting accuracy.

Last Point

In conclusion, business inventory fiscal year tax is a multifaceted topic that requires careful consideration. By understanding the concepts Artikeld in this guide, businesses can effectively manage their inventory, optimize their financial performance, and navigate the complexities of tax regulations.

Embracing technological advancements and implementing sound inventory control measures will further enhance inventory management practices, ensuring accuracy, compliance, and profitability.

Questions and Answers

What is the significance of inventory management in fiscal year reporting?

Inventory management plays a vital role in fiscal year reporting as it directly impacts the calculation of cost of goods sold, which is a key component of the income statement. Accurate inventory records ensure reliable financial reporting and provide valuable insights into business performance.

How do different inventory valuation methods affect taxable income?

Inventory valuation methods such as FIFO, LIFO, and average cost have varying tax implications. FIFO (first-in, first-out) results in higher taxable income during periods of rising prices, while LIFO (last-in, first-out) has the opposite effect. Average cost provides a more stable taxable income over time.

What are the key principles of inventory control?

Effective inventory control involves maintaining accurate inventory records, implementing inventory tracking systems, conducting regular inventory audits, and establishing clear inventory management policies. These measures help prevent theft, damage, and obsolescence, ensuring optimal inventory levels and reducing costs.