Accounting and inventory software for small businesses is a game-changer, offering a seamless solution to manage your finances and streamline operations. With its robust features and intuitive design, it empowers small businesses to make informed decisions, optimize inventory, and achieve financial success.

From invoicing and expense tracking to stock management and order fulfillment, accounting and inventory software provides a comprehensive suite of tools to simplify complex tasks and enhance efficiency.

Overview of Accounting and Inventory Software for Small Businesses

Accounting and inventory management are crucial aspects for small businesses to maintain financial stability and optimize operations. Accounting software automates accounting tasks, while inventory software tracks and manages inventory levels. Together, they provide insights into financial performance, streamline processes, and reduce errors.

Key features and benefits of accounting and inventory software include:

- Automated invoicing and billing

- Expense tracking and categorization

- Inventory tracking and stock management

- Financial reporting and analysis

- Improved efficiency and accuracy

- Enhanced financial visibility and control

Types of Accounting and Inventory Software

There are various types of accounting and inventory software available, each tailored to specific business needs. Common types include:

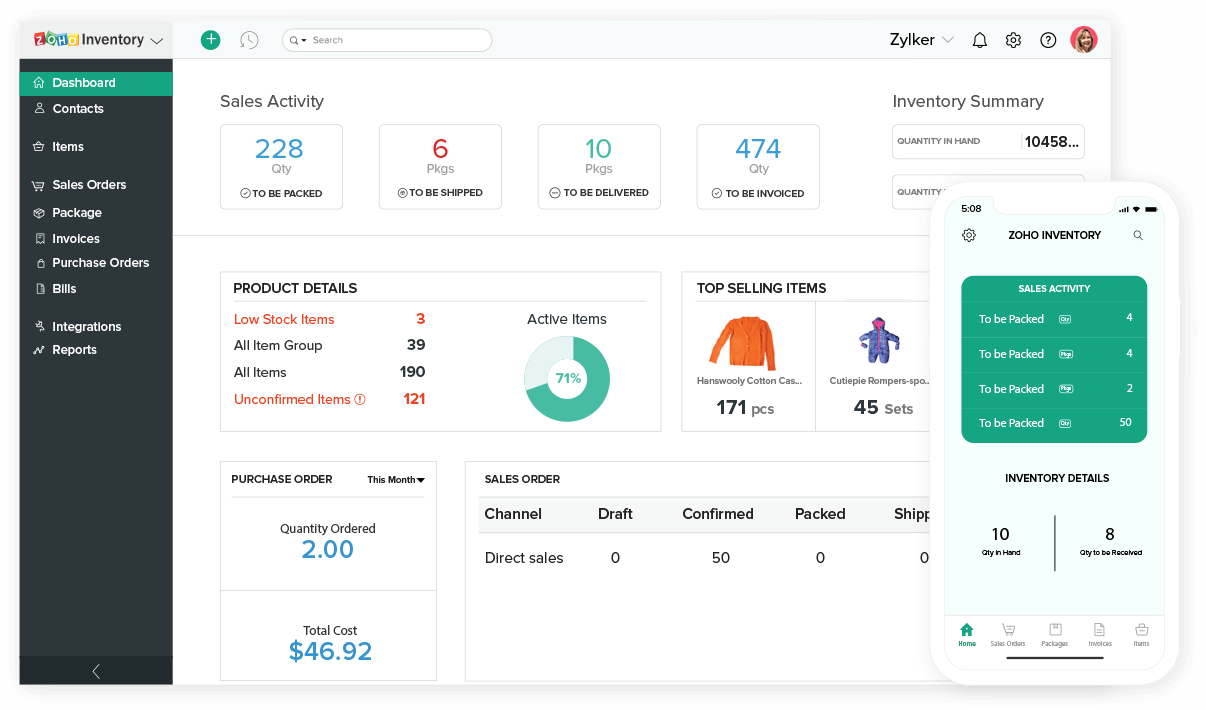

- Cloud-based software: Accessed via the internet, offers flexibility and accessibility.

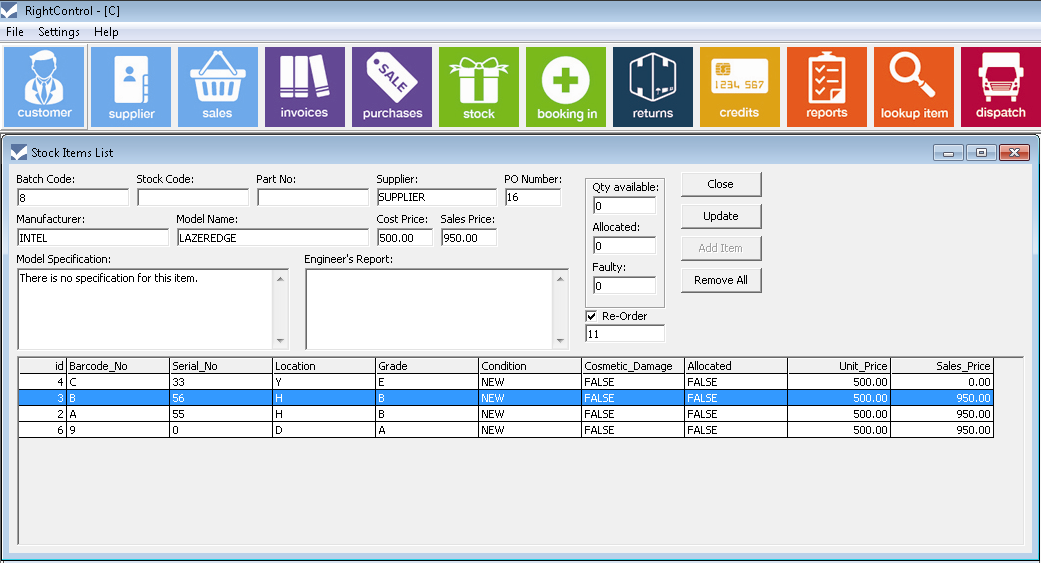

- Desktop software: Installed on a local computer, provides more control but limited accessibility.

- Integrated software: Combines accounting and inventory management into a single platform.

- Modular software: Allows businesses to choose and integrate specific modules as needed.

Features to Consider When Choosing Accounting and Inventory Software

Choosing the right accounting and inventory software is crucial for small businesses. Here are some essential features to consider when making your selection:

Accounting Software Features

- Invoicing: Create and send professional invoices with ease.

- Expense Tracking: Keep track of expenses, categorize them, and generate expense reports.

- Financial Reporting: Generate key financial reports like balance sheets, income statements, and cash flow statements.

- Bank Reconciliation: Easily reconcile bank statements with your accounting records.

- Tax Calculations: Automate tax calculations to ensure compliance and accuracy.

- Payroll Management: Manage employee payroll, including salaries, deductions, and tax filings.

Inventory Management Software Features

- Stock Tracking: Track inventory levels in real-time to prevent overstocking or understocking.

- Order Management: Process customer orders, track order status, and manage shipping.

- Inventory Valuation: Determine the value of your inventory using different valuation methods (e.g., FIFO, LIFO).

- Barcode Scanning: Integrate barcode scanners to streamline inventory management processes.

- Reporting: Generate reports on inventory levels, sales performance, and other key metrics.

- Integration: Ensure compatibility with your existing accounting software or other business systems.

Benefits of Using Accounting and Inventory Software: Accounting And Inventory Software For Small Business

Accounting and inventory software can significantly benefit small businesses by improving financial accuracy, streamlining processes, and enhancing decision-making. Moreover, inventory management software helps reduce stockouts, optimize inventory levels, and increase sales.

Benefits of Accounting Software

Accounting software provides several advantages for small businesses:

- Improved financial accuracy: Automated calculations and record-keeping reduce errors and ensure the accuracy of financial statements.

- Streamlined processes: Automating tasks such as invoicing, expense tracking, and bank reconciliations saves time and effort.

- Enhanced decision-making: Real-time financial data and reporting provide valuable insights for informed decision-making.

Benefits of Inventory Management Software

Inventory management software offers numerous benefits for small businesses:

- Reduced stockouts: Accurate inventory tracking helps businesses avoid stockouts and ensure product availability.

- Optimized inventory levels: Software helps businesses maintain optimal inventory levels, reducing waste and carrying costs.

- Increased sales: By preventing stockouts and optimizing inventory, businesses can increase sales and improve customer satisfaction.

Real-Life Examples

Many small businesses have experienced significant benefits from using accounting and inventory software:

- Example 1: A small retail store implemented accounting software and reduced its accounting time by 50%, freeing up more time for customer service.

- Example 2: A manufacturing company used inventory management software to optimize its inventory levels, resulting in a 15% increase in sales.

4. Implementation and Integration

Implementing accounting and inventory software for small businesses involves several key steps:

1. Planning and Preparation: Define the business’s specific needs, establish a budget, and create a project timeline.

2. Software Selection: Research and evaluate different software options, considering features, pricing, and compatibility with existing systems.

3. Data Migration: Transfer existing accounting and inventory data from the old system to the new software. Ensure data accuracy and completeness.

4. System Integration: Connect the accounting and inventory software with other business systems, such as POS systems or e-commerce platforms, to streamline operations.

5. Training and Adoption: Provide training to employees on how to use the new software effectively and encourage its adoption throughout the organization.

Importance of Data Migration and System Integration

Data migration and system integration are crucial for a successful software implementation:

– Data Migration: Accurate and complete data transfer ensures seamless continuity of operations and minimizes disruptions.

– System Integration: Connecting the software with other business systems eliminates manual data entry, reduces errors, and improves efficiency.

Tips for Ensuring a Smooth Transition to New Software

To ensure a smooth transition to new accounting and inventory software:

– Involve Key Stakeholders: Engage key users and decision-makers in the planning and implementation process to ensure buy-in and support.

– Communicate Effectively: Keep employees informed about the changes and provide clear instructions and training materials.

– Test Thoroughly: Conduct thorough testing of the software before going live to identify and resolve any issues.

– Provide Ongoing Support: Offer ongoing support and training to users to address any challenges and ensure continued success.

Best Practices for Using Accounting and Inventory Software

Optimizing the use of accounting and inventory software can significantly enhance financial management and operational efficiency for small businesses. Here are some best practices to help you get the most out of your software:

Managing Accounts Receivable and Payable

Effective management of accounts receivable and payable is crucial for maintaining a healthy cash flow. Here are some best practices:

- Invoice promptly and accurately: Send invoices to customers as soon as goods or services are delivered to minimize delays in payment.

- Offer flexible payment options: Consider providing multiple payment methods and early payment discounts to encourage timely payments.

- Monitor accounts receivable regularly: Track overdue invoices and follow up with customers to ensure prompt payment.

- Manage accounts payable efficiently: Pay bills on time to maintain good relationships with suppliers and avoid late payment penalties.

- Reconcile bank statements: Regularly compare bank statements with accounting records to identify and correct any discrepancies.

Optimizing Inventory Levels and Minimizing Waste

Efficient inventory management is essential for minimizing waste and maximizing profitability. Here are some best practices:

- Maintain accurate inventory records: Use the inventory software to track inventory levels in real-time, ensuring accuracy and preventing overstocking or understocking.

- Use inventory forecasting techniques: Analyze historical data and market trends to forecast future demand, enabling informed inventory decisions.

- Implement just-in-time inventory: Order inventory as close to the time it is needed, reducing storage costs and waste.

- Conduct regular inventory audits: Physically count inventory periodically to verify accuracy and identify any discrepancies.

- Establish reorder points: Set inventory levels that trigger automatic reorders when stock falls below a certain threshold.

Leveraging Reporting Features to Improve Financial Performance

Accounting and inventory software provide robust reporting capabilities that can be leveraged to gain insights into financial performance. Here are some best practices:

- Generate regular financial reports: Create profit and loss statements, balance sheets, and cash flow statements to track financial performance.

- Use reports to identify trends and patterns: Analyze financial data over time to identify areas for improvement and make informed decisions.

- Compare performance to industry benchmarks: Benchmark your financial performance against industry averages to identify areas where you can improve.

- Use reporting to support decision-making: Leverage financial reports to make informed decisions about pricing, inventory management, and other aspects of your business.

- Seek professional advice when needed: Consult with an accountant or financial advisor to interpret financial reports and make recommendations for improvement.

Cloud-Based vs. On-Premise Software

Small businesses face a critical decision when choosing between cloud-based and on-premise accounting and inventory software. Both options offer unique advantages and disadvantages, and the best choice depends on the specific needs and resources of the business.

Cloud-based software is hosted on remote servers and accessed via the internet, while on-premise software is installed on the business’s own computers. This fundamental difference leads to several key distinctions between the two options.

Factors to Consider, Accounting and inventory software for small business

- Cost: Cloud-based software typically requires a monthly subscription fee, while on-premise software requires a one-time purchase and ongoing maintenance costs.

- Accessibility: Cloud-based software can be accessed from anywhere with an internet connection, while on-premise software is limited to the computers on which it is installed.

- Security: Both cloud-based and on-premise software can provide robust security measures, but the responsibility for data protection ultimately falls on the business with on-premise software.

- Scalability: Cloud-based software can easily scale to meet changing business needs, while on-premise software may require additional hardware or software upgrades.

- Customization: On-premise software typically offers more customization options, but cloud-based software may provide pre-built integrations and features that meet the needs of most small businesses.

Recommendations

For small businesses with limited IT resources and a need for flexibility and accessibility, cloud-based software is often the better choice. It offers a cost-effective and easy-to-manage solution that can grow with the business.

On the other hand, businesses with specific customization requirements or concerns about data security may prefer on-premise software. It provides more control over the software and data, but requires more upfront investment and ongoing maintenance.

Final Conclusion

By leveraging the power of accounting and inventory software, small businesses can gain a competitive edge, improve profitability, and lay the foundation for sustainable growth. Embrace the transformative potential of these solutions and unlock the full potential of your business.

Questions and Answers

What are the key benefits of using accounting and inventory software?

Improved financial accuracy, streamlined processes, reduced stockouts, optimized inventory levels, and enhanced decision-making.

How do I choose the right accounting and inventory software for my business?

Consider essential features like invoicing, expense tracking, stock tracking, order management, and reporting capabilities that align with your specific business needs.

What are the best practices for using accounting and inventory software?

Regularly reconcile accounts, optimize inventory levels to minimize waste, and leverage reporting features to track financial performance and identify areas for improvement.